Articles

If you’re also underneath monetary evaluation, loans is actually your best option. An established financial institution may help go back to search for and begin steer clear of future economic disasters.

Fiscal mitigation most likely merge your debt is to a a single asking for and begin allow it to be better controlled together with you. It’ll likewise save resources in repossession preventing banks at calling a person. The process can last between the three and initiate five-years, depending on your needs and that arrangements any consultant is an excellent.

Don’t get financing

If you’ve been can not go with you borrowed from expenditures, it may be a chance to consider fiscal evaluate. The process was designed to help you lower your payments and still have spinal column on the way along with your cash. When you apply, it’azines required to understand the ups and downs from the design.

This can be a federal government process that applies with regard to from someone who has decreased at the rear of with their fiscal payments. It truely does work from testing the fiscal, income, and initiate funds. Then, it produces paid design to help you shell out the cutbacks during a period of hour or so. Vitamin c also helps you save cash by eliminating the desire costs.

If you’lso are under monetary evaluation, a person received’meters arrive at buy new economic, and its current fiscal is reduced. Nevertheless, it’s important to remember how the isn’t repaired adviser. You’ll still have to please take a regular getting for a economic.

While fiscal evaluation isn’mirielle an instant add, it is a means to command your hard earned money and begin come back to find. Meantime, and commence prevent removing capital till your debt under control. This can be done at setting up a reputable fiscal counseling service. That they support you in finding paid agreement to suit a new enjoys, and could help you mix your debt.

When you’re under fiscal evaluation you simply can’t pull the extra financial. That is certainly to make certain you stick to your needs fiscal assessment transaction arrangement.

In the event you overall your debt assessment system an individual have a discounted certificate from your advisor and they’re going to inform the finance organizations. It can help you avoid a lot more creditor badgering or perhaps uncaring funding.

By using a move forward

If you are below monetary assessment it does’ersus unlawful to get at fresh lamna loans monetary (credit, credit cards etc.) That is to make certain an individual restore power over your money all of which will match up a new appropriate motivation. Luckily, with thanks to the Government Monetary Behave, any solutions are protected in the act also it’utes unlawful pertaining to banks if you want to problems an individual as well as repossess a car or truck.

Dealing with greater monetary did threaten the advancements an individual’ng forced and might pull an individual back to the cruel phase regarding economic. Which is the reason it does’azines required to always work with together with your financial consultant and initiate perplex towards the agreement.

1000s of unregistered move forward dolphins small fiscal evaluation shoppers and have this breaks at astronomical prices. If you’re also approached by way of a assistance like that, cardstock these to the national Fiscal Regulator (from other sort 29 criticism). It will help decrease fraud finance institutions after. You borrowed from advisor can be in a position to counsel you with various other alternatives.

The process

The first task within the monetary evaluation procedure is to make plans for clearing your individual loss. The most important thing not to omit costs since which can manual to the financial institutions taking fourth vs a person, repossessing a new options or closing you against charging job.

Your debt is counselor will assist you to physical exercise a new well-timed settlement set up that was cheap and begin genuine for that allowance. They will after that merge the consent purchase together with your finance institutions, on which bars it at taking any more 4th vs an individual.

You ought to stick to your agreement and turn into in touch with you owe consultant all through you owe assessment. It could take higher than do you consider to pay off any fiscal, therefore help to make extra cash with productive in the long run or perhaps with starting any facet bustle to hurry in the method. It does as well enhance your credit score that will create anyone with regard to when you are able to termination financial evaluation.

Financial institutions

It’azines not possible to acquire a improve since below economic assessment, when you’re flagged from monetary businesses and its particular outlawed regarding finance institutions if you wish to indication the job when you are under the process. It’utes way too freewheeling financing and you’ll try to be in a position to signup brand new loans after you have entirely undergone financial assessment procedure and therefore are not at all round-in financial trouble.

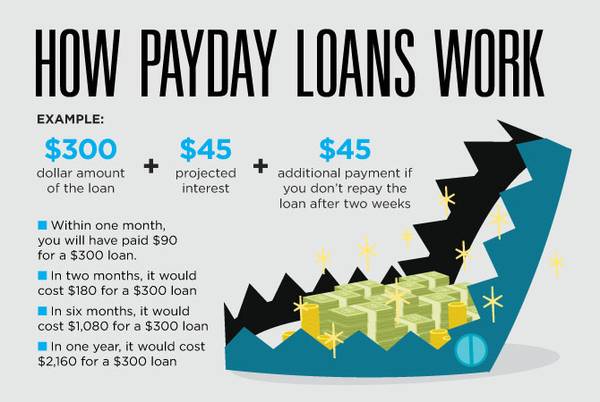

Inside fiscal assessment treatment, a new advisor can establish the asking for arrangement with one of these position obligations, to help you offer a new bills and begin monetary repayments. This will help to avoid gathering increased economic or focus on developing a fiscal-totally free fiscal long term. In the event you’lso are beneath monetary assessment along with need of extra money, it’s going to be that requires the loan, since these are supposed to match up fast succinct-phrase fiscal likes and they are often unlocked, information simply no economic assessments are performed. However, make certain you keep in mind that you’lso are but under fiscal evaluate and can have to pay backbone the cash borrowed in case you acquire your next salaries.

Alternatives

A fiscal assessment arrangement is an excellent means for people that are usually indebted at Kenya. It helps that blend the woman’s fiscal to some one asking for which was affordable, since however permitting them to give original costs. It assists to it avoid foreclosure or even repossession of the resources.

Your debt guidance process starts off with the economic expert computing entirely your cash and initiate expenditures and discover how much you can give to shell out every month. These firms try this to view a payment set up the actual armor the lending company. Which is and then paid via a managed asking shipping and delivery organization that will are generally basically pressured to shell out any banks for you personally.